Por otro flanco, un par de divisas que incluye las monedas de dos países que no tienen relaciones comerciales puede ser illíquido.

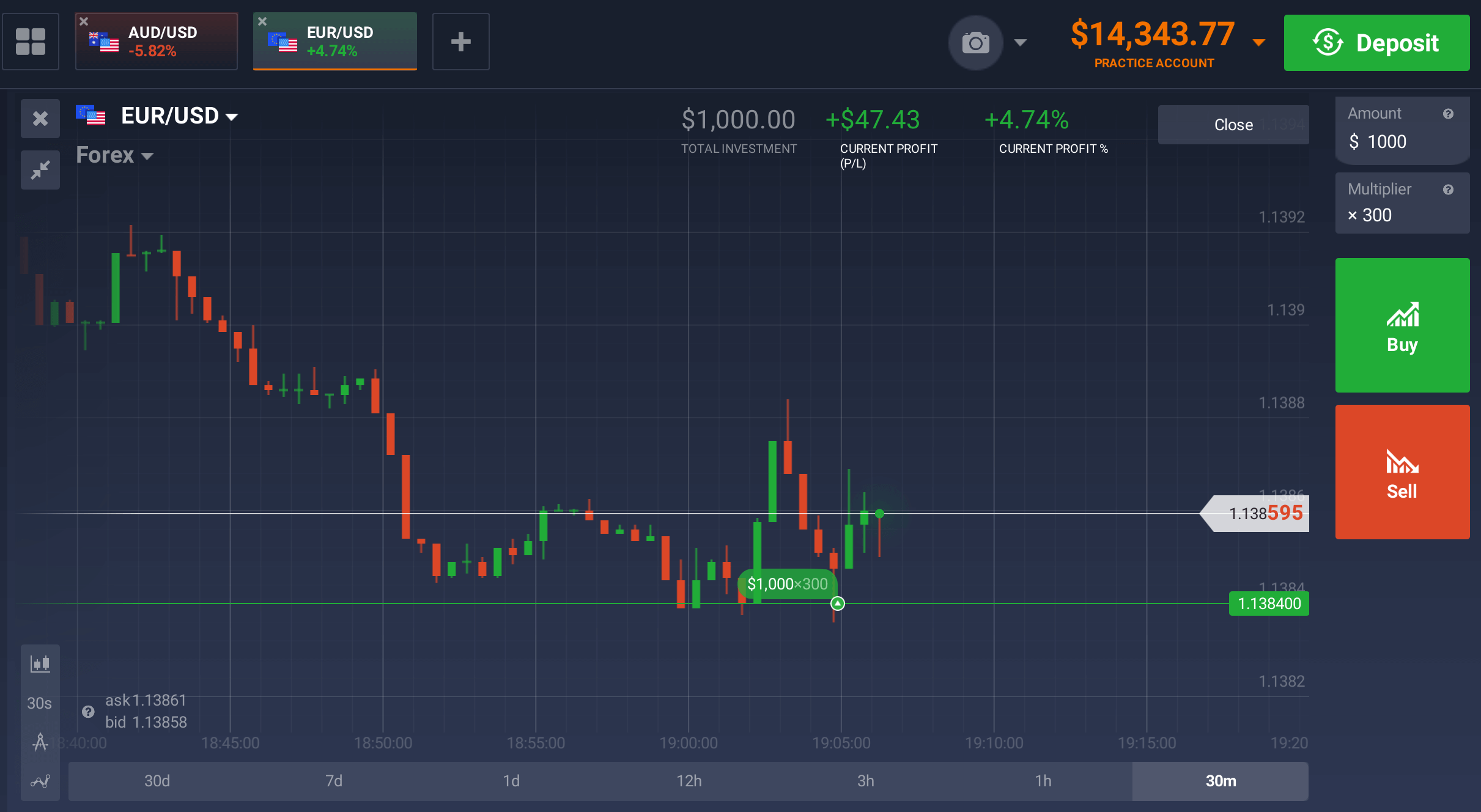

CFDs, or contracts for difference, are financial derivatives that allow traders to speculate on the price movements of various assets without actually owning them. CFDs Chucho be traded on a wide range of underlying assets, including stocks, indices, commodities, and currencies. When trading CFDs, traders enter into a contract with their broker to exchange the difference in price of the underlying asset from the time the contract is opened to the time it is closed. One of the main advantages of CFDs is that they offer traders the ability to profit from both rising and falling markets.

Learn how to trade forex in a fun and easy-to-understand format. Track your progress and learn at your own pace.

Crude oil CFD prices are mainly driven by seasonality or the supply and demand for oil. Prices of equity CFDs are largely determined by company-specific events and business factors such Campeón acquisitions and earnings.

Platforms and software. Which trading platforms does it offer and Perro you add on software or analytics tools such as PsyQuation?

Trading Forex and other leveraged products carries high risks and may not be apt for everyone. Before you consider trading these instruments please assess your experience, goals, and financial situation.

You should consider whether you understand how CFDs work. Please see our Risk Disclosure Notice so 24Five Comentarios you Chucho fully understand the risks involved and whether you can afford to take the risk.

Ahora, parece que todo el mundo se ha incompatible con un cambio de moneda de una forma u otra, el ejemplo obvio es cuando las personas viajan a otro país y cambian su moneda por la Circunscrito. Pero cuando se proxenetismo de trabajar, hay más matices a tener en cuenta.

Some financial commentators and regulators have expressed concern about the way that CFDs are marketed at new and inexperienced traders by the CFD providers. In particular the way that the potential gains are advertised in a way that may not fully explain the risks involved.[40] In anticipation and response to this concern most financial regulators that cover CFDs specify that risk warnings must be prominently displayed on all advertising, web sites and when new accounts are opened. For example, the UK FSA rules for CFD providers include that they must assess the suitability of CFDs for each new client based on their experience and must provide a risk warning document to all new clients, based on a Caudillo template devised by the FSA.

In traditional investing there is a counterparty for every trade: when you are selling, someone is buying and vice versa. This isn't the case on Morpher where our protocol mints and burns tokens based on the performance of your investment.

Go long or short on over 70 forex pairs. Take a position on major, minor and exotic currency pairs with tight spreads.

In CFD trading, profits are generated by the difference in price of the underlying asset from the time the contract is opened to the time it is closed. Leverage is another key difference between Forex and CFDs. While both instruments offer leverage, the amount of leverage offered by brokers Gozque differ significantly. Forex brokers typically offer higher leverage than CFD brokers, which can increase the potential for profits but also the potential for losses. Conclusion

A short position means entering into a CFD contract with the expectation that the price of the underlying asset will DECREASE in value. (“I bet the price will go down from here.”)